As someone who writes regularly about credit and charge cards—specifically, travel-rewards cards—I’ve often found myself chasing after a key data point.

It’s well known that American Express charges higher merchant fees, and that fewer merchants accept their cards as a result. What’s been harder to pin down was the exact number of Amex merchants, to be compared with the number of merchants in the Visa and MasterCard networks.

That’s a meaningful comparison when it comes to convenience and utility. All things being equal, a card that’s accepted by more merchants is more useful than a card that’s accepted by fewer merchants.

Visa and MasterCard have always been fairly transparent when it comes to revealing the size of their merchant networks. (Because Visa and MasterCard are seen as mostly interchangeable by consumers, and because they charge the same merchant fees, their networks are roughly the same size.)

Related:

Getting that information from Amex, on the other hand, has proven more challenging. The information, I was told, was “competitively sensitive.” No surprise. American Express is a company known for its arrogance, and it stands to reason it wouldn’t want to quantify its competitive weaknesses.

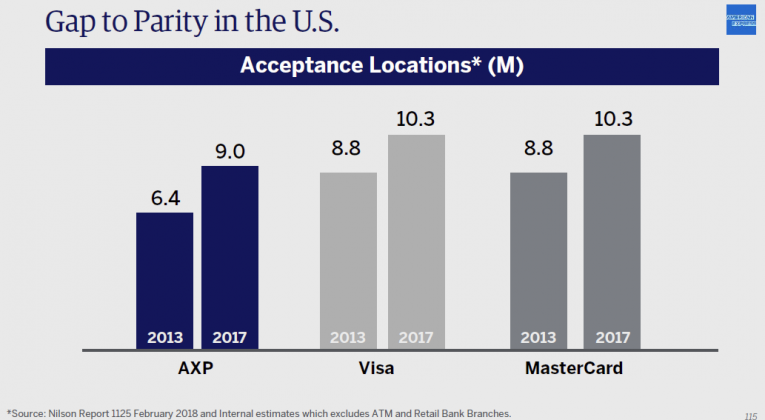

But in an investor presentation (.pdf) earlier this month, American Express laid out its strategy for increasing its merchant base (by reducing merchant fees, predictably), and included some current numbers for the three U.S. networks, including its own:

- American Express – 9.0 million merchants

- Visa – 10.3 merchants

- MasterCard – 10.3 merchants

So there you have it. As things currently stand, around 1.3 million more U.S. merchants accept cards from Visa and MasterCard than from Amex. Not necessarily a deal-breaker, but something to consider when deciding whether to apply for an Amex Platinum card or a Chase Sapphire Reserve (Visa) card.

Given Amex’s goal of approaching parity with Visa and MasterCard, that gap is likely to narrow going forward. In 2017 alone, Amex added 1.5 million merchants to its network. But Visa and MasterCard’s are undoubtedly growing as well. Another data point to track down …

Reader Reality Check

When choosing a credit or charge card, do consider the size of the merchant network?

After 20 years working in the travel industry, and almost that long writing about it, Tim Winship knows a thing or two about travel. Follow him on Twitter @twinship.

This article first appeared on SmarterTravel.com, where Tim is Editor-at-Large.

Perhaps it’s because they charge merchants a higher fee, but I like AMEX because usually the benefits are greater.

Take the Starwood Preferred Guest AMEX, for example. which for routine charges gives one Starpoint per dollar (more if you’re charging at a Starwood or Marriott property). Compared to other cards that give one airline mile (value <2 cents) or a few hotel points (usually worth about a penny total) or "double" Capital One miles, worth one cent each so about equal to an airline mile (sorry, Jennifer), I consider a Starpoint to be worth 3 cents in redemption value, or 1.25 airline miles.

My Starwood AMEX is my go-to card, but I also carry a VISA or MC for those occasions when a vendor doesn't take AMEX.