Marriott Bonvoy is perhaps the hotel chain where the decision to use points or pay cash is hardest. Having prreviously looked at Hilton Honors and World of Hyatt, today I’ll look at Marriott Bonvoy.

Step One is Always Math (Sorry!)

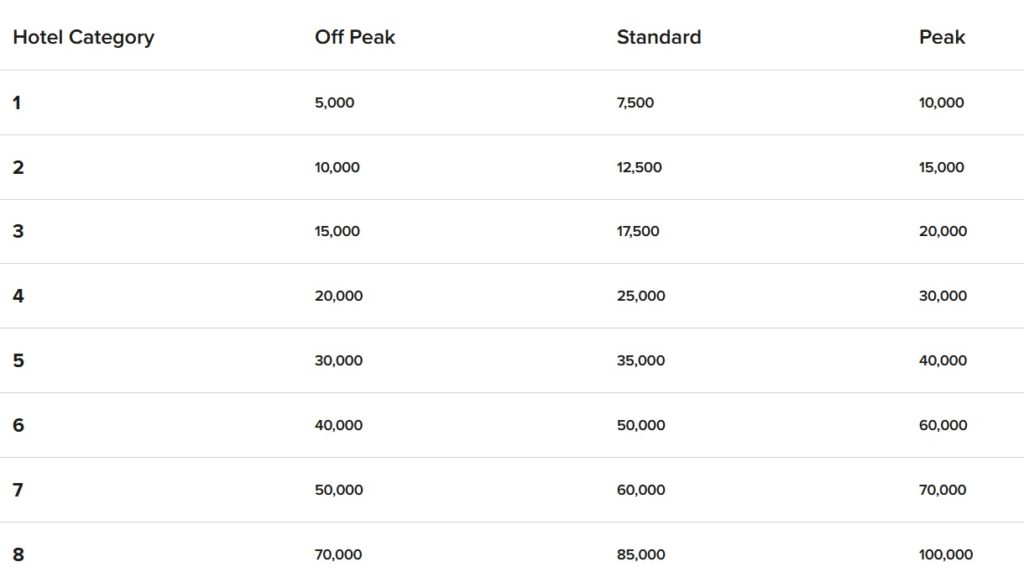

Marriott Bonvoy allow members to book standard rooms using points. Some hotels also allow you to use points for suites or other preferred rooms, but most hotels only offer standard rooms when redeeming your points.

It doesn’t matter whether you book using points or whether you pay cash – you will get the same room. And if you enjoy elite status, you will have the same chances of receiving an upgrade. So you really are just comparing two different payment methods.

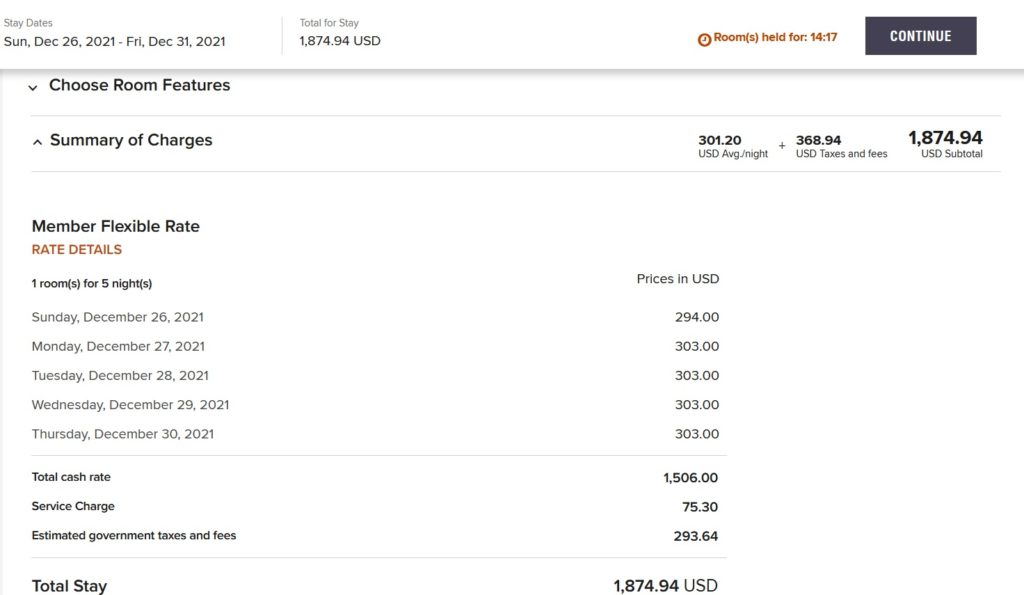

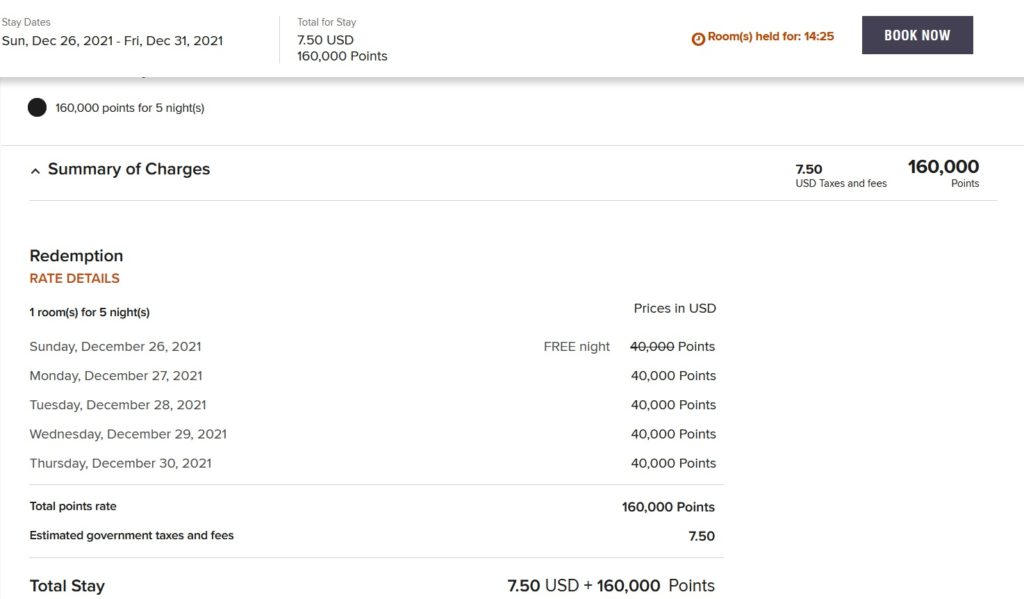

Here’s an interesting example from the Renaissance hotel in Cancun, Mexico…

It is VERY IMPORTANT to include all service charges and taxes, because you will NOT have to pay these on a full award stay with Marriott Bonvoy. However you DO need to pay any resort fees (or similar) and any local taxes, even when spending points.

In this example, I could pay 160,000 points in total, or $1,875 in total.

You simply divide one by the other in order to calculate a “cents per point” – $1875 / 160,000 = 1.17 cents per point.

Is That Good or Bad?

It depends on your own perspective…

But I like to compare this to the cost of BUYING points from Marriott Bonvoy. The most common promotion allows you to buy Marriott points with a 50%, working out to 0.83 cents per point. So this provides a valuable reference point.

Since you could buy Marriott points for 0.83 cents and redeem them for 1.17 cents in my example above, you are probably on the right track…

But You Earn More Points When Paying Cash for Your Room

… yes you do. Especially when there are interesting promotions happening. With Marriott, only paid stays qualify for promotions, even when the promotion offers a fixed number of points per night / stay.

If you pay cash for my Mexican example, your rate would be $1,506 pre-tax. You would therefore earn:

- 10 base points –> 15060 points

- 5 Platinum tier bonus points –> 7530 points

- 6 co-branded credit card points –> 9,036 points

- for a total of 21 points per dollar – 31,626 points

So Your “Opportunity Cost” is Higher

By redeeming points instead of paying cash, you could be forgoeing the chance to earn at least 31,626 points. So, your “opportunity cost” when redeeming points is actually 191,626 points (160k +31626). Compare that to the $1875 cash cost and you’d be getting 0.98 cents.

I hope that it’s not getting too complicated, but it does demonstrate that you might want to buy points during the next 50% bonus promotion…

Don’t Forget Airline Miles Conversions

Marriott is unique among the major hotel chains; it allow conversions of hotel points into airline miles at an attractive rate of 3:1, with a bonus for converting in chunks of 60,000 points. If you convert exactly 60,000 Marriott points, therefore, you will receive 25,000 miles. Airline miles have wildly different values, however. I am usually quite willing to convert Marriott points into miles with Alaska Mileage Plan or Turkish Miles & Smiles. But I would never even contemplate Avios or Avianca Lifemiles…

The possible valuation of miles adds even more complication to the analysis. Rather than go down into that rabbit hole, it’s simply worth remembering that Marriott points have a floor valuation – which is 25/60 of whatever you think your favorite 2 or 3 miles currencies are worth.

When Should I Spend my Marriott Points?

I usually need to book a five night stay to entice me to spend my Marriott points on a hotel stay. (click here for details of Marriott’s fifth night free benefit)

As a result, my rule of thumb is:

- 1 cent of value or higher –> ALWAYS use points (I can buy more later if needed)

- 0.8 – 1.0 cents of value –> PROBABLY use points (unless there is a double or triple point promotion)

- less than 0.8 cents of value –> ALMOST NEVER use points (the points would be worth more to me as airline miles)

The Bottom Line

The rule of thumb I highlighted above works really well for me. Even though my Marriott points balance does tend to increase over time – meaning that redemption opportunities are fewer than I would like – my balance always drops down when I need a substantial number of miles to book my next international flight in Business or First Class…

Enjoyed the read. Very informative!

Hello, I have a question about the math,

you show above that $1875 / 160,000 = 1.17 cents per point,

and when I use the trusty calculator I get a result of 0.0117….

Where is it going wrong or do I just always assume to mentally shift the decimal point over. Thx.

There are 100 cents in a dollar, so you move the decimal point by 2 places…