Sometimes, better deals are hiding in plain sight.

Want a better credit card interest rate? A higher credit limit? A late-payment fee waived? A lower annual fee?

Most credit-card users would answer “Yes!” to one or more of those questions. And yet very few consumers take the initiative to make those requests of their credit card companies. That silence represents an enormous missed opportunity, according to a new survey by a credit-card website.

In a survey of 952 U.S. cardholders, CreditCards.com found that 84 percent of those who made one of the four aforementioned requests were rewarded with a positive response from the credit-card company.

The success rates:

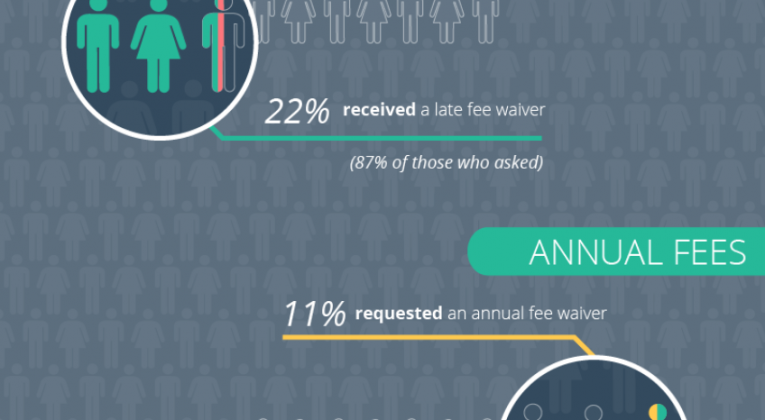

- 89 percent received a higher credit limit

- 87 percent received a late-payment fee waiver

- 82 percent had their annual fee waived or reduced

- 69 percent received a lower interest rate

While the overall outlook is good, the survey data showed that there are significant differences in the success rates among different generations. The most successful, and the most aggressive, age group is the young baby boomers, who tend to be in their peak earning years:

Younger baby boomers (ages 53 to 62) are the most aggressive in asking for annual fee waivers, according to the poll – and they’re extraordinarily successful. Almost all of them (97 percent) who asked had the fee either reduced (19 percent) or waived altogether (78 percent). Boomers also had the highest success rates when they asked for other breaks.

On the other hand, young millennials, aged 18 to 26, had much lower success rates when requesting special consideration.

Related:

The disparity in age-related results is hardly surprising. The big-spending baby boomers are much more profitable for the credit-card companies than younger consumers, and thus command more flexibility when it comes to special requests.

Nevertheless, wherever you fall on the age spectrum, it’s worth investing a few minutes of your time to ask for what could potentially be a significant savings. It’s just a phone call, toll-free, and the worst that can happen is that your request will be denied.

Reader Reality Check

How successful have you been with special requests to your credit-card issuer?

After 20 years working in the travel industry, and almost that long writing about it, Tim Winship knows a thing or two about travel. Follow him on Twitter @twinship.

This article first appeared on SmarterTravel.com, where Tim is Editor-at-Large.

I so seldom have a late-payment problem (maybe once in two or three years) that I have been able to get each waived when I asked. I doubt I’ve ever had to ask for a second waiver on the same account, so can’t say what would happen in such a case.

I’ve only had to ask for an increase in my credit limit once, and that involved the purchase of a new car. It was granted while I was still on the phone.

I occasionally ask for waiver of the annual fee, but only on cards I don’t mind closing (e.g,, does it matter whether I have an AA MasterCard from Citi or from Barclay?). I’d say I get the waiver or an equivalent about half the time, sometimes I get a counter-offer that sounds good, and sometimes I just get turned down. But, my thought is, “Nothing ventured, nothing gained.”