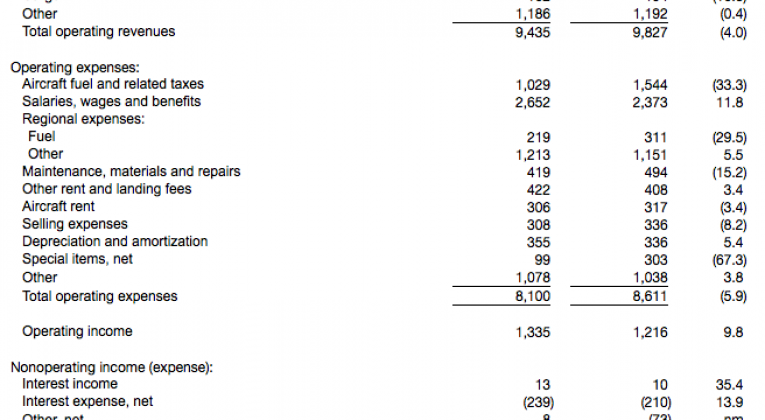

On Friday, American Airlines had its quarterly investor call and announced that it had earned more than $1.3 billion in operating income for the quarter, but it’s what they said about the future that spooked investors on the day. Here’s what we learned:

Revenues Are Still Weak…

American announced that its second quarter RASM* would decline 6-8%, apparently below what investors were expecting, as the stock declined 4.5% on the day. While the comparisons to last year’s declines mean that the second half of the year will be easier than the first, American is still seeing heavy competition in Dallas and weakness in its key Latin America markets. Dallas is a highly profitable hub for the airline, but Southwest is growing out of Love Field. The plus side is that Southwest will eventually run out of new slots, likely in the third quarter.

While Costs Are Rising…

In short, we believe the best way, as most industries do, to pay our working team is to give them an industry-leading base wage instead of lower wages and then give them a share of the profits at the end of the year. But as it became more clear over time that our competitors were not going to do the same, it became a real issue for our team and therefore for shareholders. And while the team understood the logic we couldn’t get past a collective view amongst the team that the Company didn’t appreciate their contributions to the success of the team. And that certainly wasn’t the intent nor the view. So we implemented a unilateral 5% profit-sharing program, the first accrual of which is in these results. The accrual was $73 million for our team. We’re quite pleased with that and believe US shareholders should be as well.

-American Airlines CEO Doug Parker

Winner of the oddest quote of the day goes to American Airlines CEO Doug Parker, who found a way to blame other airlines for his cost problems. Two years ago, American swore off profit-sharing for its employees, promising them higher salaries instead. Employees would trade off the potential upside of profit sharing for higher everyday wages. Both sides agreed to it. And then, fuel prices plummeted and profits soared. American’s competitors were forced to match the wage increases (or will be forced to do so), but employees at those airlines refused to give up their profit sharing agreements. Morale among line employees suffered and American was forced to do something historic: It offered employees a raise during a period when the contract was not open. That means that the company will not only have higher costs from its new contracts but also pay out profit sharing. If oil prices keep creeping up, the airline will feel it.

But It’s Not All Bad

American is currently putting out RFPs for its next credit card partner, as its contract with Citigroup will be coming to an end. The banks buy miles from the airlines to issue to their cardholders, and recent deals have leaned heavily in favor of the airlines, starting with Delta and American Express a couple of years ago. The situation got even more competitive when Amex lost Costco, which represented 10% of its outstanding cards. By the time that American Airlines has found its new partner, the deal will likely come with a 10-figure price tag for the bank, as American is now the world’s largest airline.

——————————————————————————————————————————————

*RASM is a commonly used term to track revenue strength. It stands for Revenue per Available Seat Mile and measures the amount of revenue that the airline generates per seat, per mile flown. It is a function of both pricing and load factor.