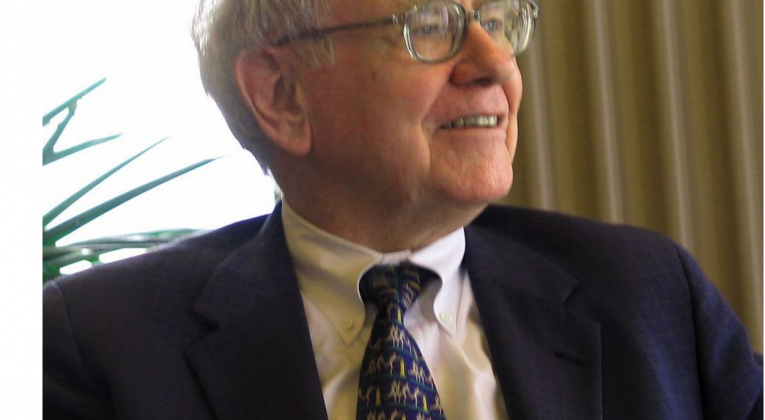

Last year, the legendary investor Warren Buffett began investing in airline stocks, shocking the investing community. For decades, Buffett had been a staunch critic of the industry’s underlying economics, and regularly unleashed scathing takedowns of airline investments. Like this, from 2002:

(T)he airline business has been extraordinary. It has eaten up capital over the past century like almost no other business because people seem to keep coming back to it and putting fresh money in. You’ve got huge fixed costs, you’ve got strong labor unions and you’ve got commodity pricing. That is not a great recipe for success. I have an 800 (free call) number now that I call if I get the urge to buy an airline stock. I call at two in the morning and I say: ‘My name is Warren and I’m an aeroholic.’ And then they talk me down.

And this, from 2013:

Investors have poured their money into airlines and airline manufacturers for 100 years with terrible results. It’s been a death trap for investors.

A death trap no more, apparently, given the significant airline stakes his holding company, Berkshire Hathaway, began accumulating last year. And according to an Associated Press analysis of Berkshire’s latest SEC filings, the company’s buying binge continues. The latest Berkshire airline holdings: 45.5 million shares of American, 60 million shares of Delta, 43.2 million shares of Southwest, and almost 29 million shares of United Continental.

What accounts for Buffett’s pivot is bad news for travel consumers. In a word: consolidation.

When Buffett invested $358 million in USAir, in 1989, the airline industry was highly competitive. There were no fewer than 10 U.S. airlines referred to as “major carriers,” the Big 10 as they were known. Profits were elusive and hard-won. The consumer was king. And Buffett’s investment was nearly lost when the airline veered close to bankruptcy.

Today, following years of bankruptcies and mergers, 80 percent of the country’s domestic air traffic is controlled by just four airlines: American, Delta, Southwest, United. The balance of pricing power has shifted from the consumer to the airlines.

For 2016, the U.S. airlines are projected to have racked up profits totaling $20.3 billion. And because the industry has become an oligopoly, the outlook is for continued profitability for years to come.

That’s well and good for the airlines, and for Buffett, and for investors in Berkshire Hathaway and the airlines themselves. But it’s bad news for travel consumers, who have little choice but to pay whatever the airlines deign to charge.

The often repeated claim of the airlines and their boosters and lobbyists, that inflation-adjusted airfares have declined, is a cynical suppression of the full truth, which is that consumers would be paying even less if the industry was still dominated by the Big 10 instead of the Big 4.

There’s plenty to be learned from Buffett’s pivot to the airlines, not least this: If you’re looking for a deal, buy the airline’s stock, not its tickets.

Reader Reality Check

Are you a buyer or seller of airline stocks?

After 20 years working in the travel industry, and almost that long writing about it, Tim Winship knows a thing or two about travel. Follow him on Twitter @twinship.

This article first appeared on SmarterTravel.com, where Tim is Editor-at-Large.

So airlines should continue to lose money (as they had been doing for decades) and subsidize your travel? The point of running a business is to make a profit so investors get their money back (plus a return), employees get a decent pay cheque and pension, and suppliers get paid (so they can pay their employees and investors). The legacy carriers have all gone through bankruptcy which has destroyed employee pensions, reduced their salaries, and delayed fleet renewal, in addition to wiping out shareholder and debt holder equity…in effect paying you to fly. Which is an absurd model only American consumers seems think is “normal”. The industry is now rationalized and for the first time in decades actually making a profit. Somehow you think this is wrong? If you want a cheap flight fly Spirit or SouthWest. They’re part of the industry too. It’s just that DL, AA, UA and AS don’t have to lose billions any more and can now reward their investors and employees. (And nothing stops you from buying airline shares and sharing in some of those profits. That’s what I understand to be the American way!)