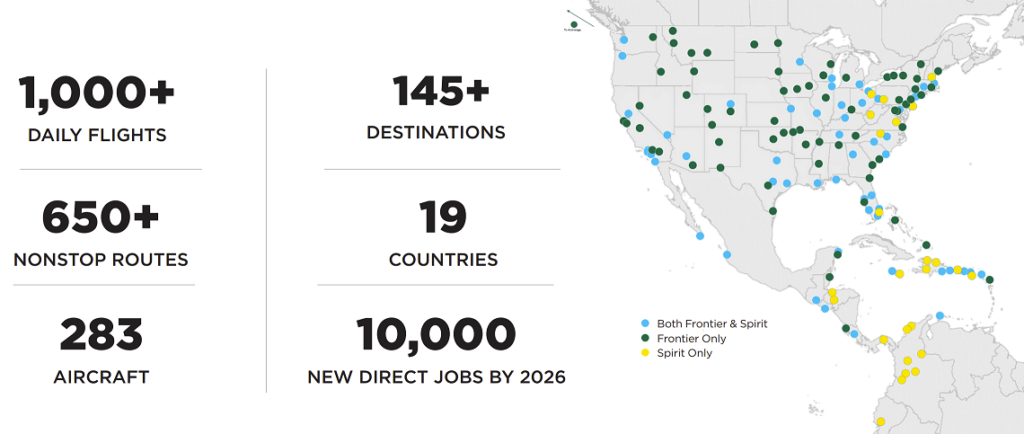

Frontier Airlines and Spirit Airlines have announced that they are going to merge to form the fifth largest airline in the United States. The transaction is expected to close in late 2022; full integration of the two airlines will take much longer of course.

Although this makes little difference to consumers, Frontier is actually taking over Spirit.

- Frontier equityholders will own 51.5% of the combined company

- Spirit shareholders will receive Frontier stock and cash

- 7 of the combined company’s 12 directors will be named by Frontier

Will there be any benefit for consumers?

It is easy to be cynical when reading about corporate mergers. Despite the frequent mention of “annual consumer savings”, the fundamental aim of most mergers and takeovers is to reduce competition – thereby allowing for higher airfares – and reducing costs from the always-mentioned “synergies”. Both concepts make shareholders rather happier than consumers…

But assuming that you aren’t completely allergic to flying on an “ultra low cost carrier” such as Frontier or Spirit, the combined entity might be able to offer a more compelling frequent flyer program. Frontier has already been doing interesting things with its program, such as this recent status match opportunity.

Bottom line

As further details emerge, this merger might become more than just a curiosity for those readers who are loyal to one or more of the “Big 3” US airlines. But for now, we know very little about how the combined entity will operate.

What do you think? Let us know in the comments section…